arkansas inheritance tax laws

Info about Arkansas probate courts Arkansas estate taxes Arkansas death tax. Arkansas Inheritance and Gift Tax.

Free Arkansas Small Estate Affidavit Form 23 Pdf Word Eforms

In Arkansas a resident can make a valid will if hes at least 18 years old and mentally competent.

. An inheritance tax is a tax that some states require the recipients of inheritance to pay. In this case if the inheritor sells the property at the best value of 375000 then he pays capital gain tax against 25000 only. Estate tax on the other hand is paid by the estate of the deceased if it is required.

Info about Arkansas probate courts Arkansas estate taxes Arkansas death tax. As well as how to collect life insurance pay on death accounts and. Most states including Arkansas allow a surviving spouse and minor children to take an interest in the homestead of the decedent.

A federal estate tax applies to all transfers after death. Up to 25 cash back Arkansas Code 28-9-214 and 28-9-215 Other Arkansas Intestate Succession Rules. Arkansas also has no inheritance tax.

The process however can take longer for contested estates. Conditioning the inherited house. Arkansas does not have a state inheritance or estate tax.

However local and federal laws will apply if you collect an Arkansas residents estate but live in another state. State estate taxes are similar to federal taxes because they are. Inheritance laws of other states may apply to you though if you inherit money or assets from.

Sales and Use Tax. Arkansas does not charge an inheritance or estate tax. Arkansas law also requires a will.

Home Excise Tax Sales and Use Tax. Arkansas is generous when it comes to inheritance. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens.

Info about Arkansas probate courts Arkansas estate taxes Arkansas death tax. Here are a few other things to know about Arkansas intestacy laws. The applicable laws depend on where the decedent lived or where the owned.

There are two types of taxes that may be assessed upon an estate at the state level. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. Arkansas also provides to the surviving spouse and minor.

In non-pandemic times the probate assets personal property within an estate in Arkansas can take anywhere from 9 months to 3 years to be distributed from the decedents estate. The federal government gives relief in the form of. However not every estate is eligible to pay.

The laws regarding inheritance tax do not depend on where you as the heir or beneficiary live. The federal estate tax is calculated from the total amount of a persons estate. As well as how to collect life insurance pay on death accounts and.

Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws. Estate taxes are taken before the estate is distributed to the heirs. As well as how to collect life insurance pay on death accounts and.

Complete Guide To Probate In Arkansas

Arkansas Inheritance Laws What You Should Know

Arkansas Inheritance Laws What You Should Know Smartasset

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Divorce Laws In Arkansas 2021 Guide Survive Divorce

Every State S Most Googled Tax Topics Paladini Law

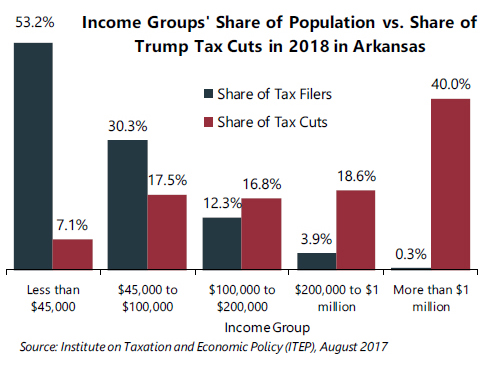

In Arkansas 40 0 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

Income Tax Department Of Finance And Administration

The National Income Tax Magazine 1925 Vol 3 Index Free Download Borrow And Streaming Internet Archive

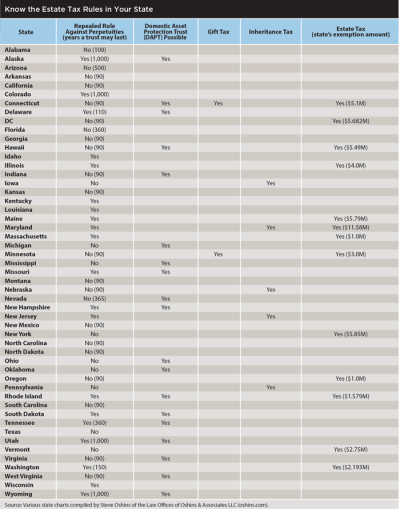

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Planning Update Financial Planning Association

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Selling An Inherited Property In Arkansas 2022 Updates

Jonesboro Arkansas Estate Tax Planning Attorneys Quraishi Law Firm Wealth Management

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Farrar Williams Pllc Probate Hot Springs

A New Study Assesses Whether Inheritance Taxes Boost Net Revenues The Economist